With election campaigning entering its critical phase you could be forgiven for thinking that Brasil was in the throes of economic meltdown, with foreign reports adding a thin sprinkling of credence to such claims & perception.

But by global, or even by Brazilian standards, is it remotely fair to call the current state of the economy a “crisis”?

Compared to what?

Those old enough to remember the 1990s may hesitate to speak about today’s economy in such terms. The presidency of Fernando Collor, curtailed mid-way following his impeachment in 1992, was characterised by hyperinflation, currency failure, and crisis upon crisis. These accompanied ‘Plano Collor’ – his centrepiece policy initiative, proposed to liberalise / globalise the Brasilian economy, having just returned to direct democracy following transition from dictatorship.

Under Collor’s replacement, Itamar Franco, ‘Plano Real’ – universally considered saviour of Brasil’s future stability, was formulated. Elected in 1994 – his successor, Fernando Henrique Cardoso, is most often credited for the subsequent implementation of Plano Real, the tightened control of inflation and restoration of public faith in currency that it enabled. However, despite improvements in stability, FHC’s second term from 1998-2002, was actually riddled with economic problems, mini-crashes & capital flight. This instability was in part blamed by the administration on imposed fiscal recipes of the IMF, but also on global crises occurring at the time such as those in Russia, Mexico & Japan. Today’s government, with external debt cleared under the Lula administration which preceded it (Brasil has been a creditor at the World Bank since 2008) doesn’t have the IMF to worry about, but is nevertheless chastened for pointing to external factors affecting the economy.

Cardoso’s second term was itself enabled by a change of constitution which allowed serving presidents to seek re-election, with a pegged USD exchange rate on his side, helped along by then US treasury head Robert Rubin. He went on to beat Lula for a second time, only for the Real to crash against the Dollar when the peg ended shortly afterwards, with foreign reserves decimated. A wave of IMF-friendly privatizations followed.

A phantom crisis

The sustained growth during Lula’s subsequent 2002-2010 presidency is often and unfairly dismissed as solely down to the foundations laid by his predecessor, especially at election time. But in August 2014, after a few years of slowing growth, albeit above European or US standards, for the first time this decade, Brasil went into a ‘technical’ recession with a fall of 0.2% – a level that many economists would actually call stability.

Since Lula’s chosen candidate to succeed him, Dilma Rousseff, was inaugurated in January 2011, despite statistical sluggishness, unemployment remains very low, inflation remains just about within government targets, and wages continue to rise. Unlike the very clear effects of global turmoil felt in a country such as Spain, where unemployment amongst the under 30s is anything up to 40% – to the average Brazilian worker, any supposed “crisis” remains phantom. GDP growth in Brasil has been higher, but also distribution of wealth far lower – the UN human development index compares the early 1990s with the present day and the differences are startling, which raises the question, “Growth for whom?”. But fear of a return to the freak levels of inflation seen during the 1980s & 1990s is deeply rooted, and with good reason.

All of this does need to be placed into the context of what has happened globally since 2008; in the period that immediately followed the crash, Brasil was the last country to enter and first to exit recession. The sensation for subsequent years was of a nation unaffected by the global crisis at all, a period which Brazilians, and many foreigners, took full advantage of.

Does this mean that economic improvement is unnecessary? of course not, but the preferred market fundamentalist formula of austerity, higher unemployment & lower wages is unlikely to be winning many votes in October.

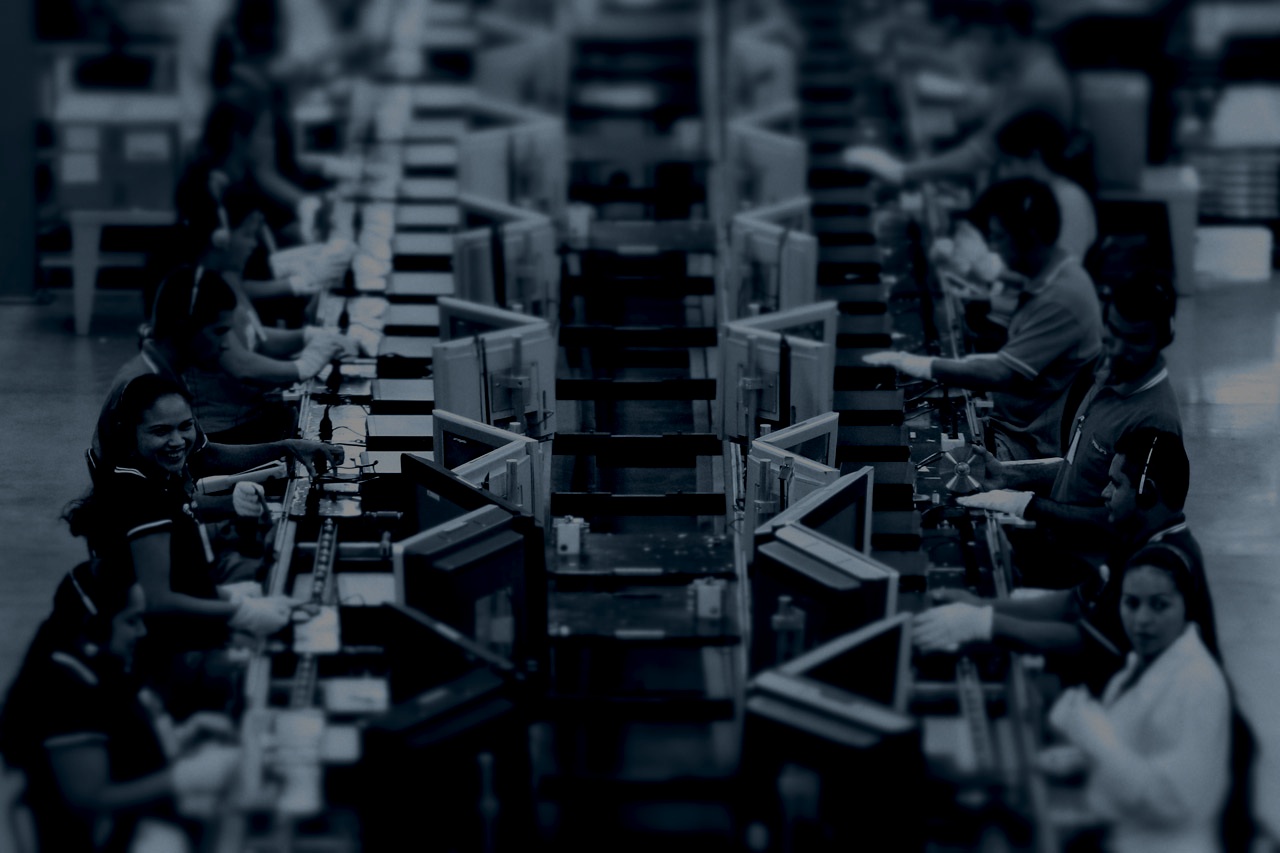

It is also important to look at direct foreign investment inflows into Brasil. Current World Bank forecasts sit at around US$65bn, still record or near record levels, and there’s little expectation that this will go anywhere but up over the coming years. Regardless of Brasil’s recent slowdown it still represents a core growth market for foreign companies within emerging economies. Brasil’s protectionist policies are often not just aimed at securing formal employment but to attract technological transfer and skills. A case point is Foxconn’s Apple manufacturing bases in four Brazilian cities with possible plans to open more in the future. Foxconn’s initial investments were made to bypass importation tariffs designed to encourage tech production within Brasil. Although Apple’s imported high end products are still extremely expensive, lower end 5C and 4S iPhones are converging with US prices and taking into account Brasil’s weak logistics and warehousing the price difference is now negligible.

But in truth, low cost luxury electronics are not one of the major problems facing Brasil. Weak infrastructure is one of the single biggest brakes on Brasil’s economic growth. A massive expansion in Brasil’s consumer base as tens of millions have left poverty due to continuing wage increase has created big problems for logistics in the country. At the same time exports of primary products have soared compounding bottlenecks and competing with the internal market for space on already loaded roads and ports. Brazil has traditionally been a poor investor in both its solid infrastructure and its population, but this has shifted significantly over the past decade. Real government investment is up, and a country that was traditionally wary of private sector involvement in strategic infrastructure projects – left or right governments – has seemingly found a model in the concession systems that satisfies internal political culture and internal investors. Today’s challenges in Brasil are, in reality, opportunities.

Brasil is not a low-hanging fruit, it is a noisy democracy with institutional structures in place from the 1988 Constitution that set the Social Democratic bar very high.

Growing pains

Despite the doom & gloom of the year or so, little has changed on the ground since Brasil was the financial media darling of 2010. Yes, there has been a slow down in GDP expansion, but it has still remained an expansion, and those that the economy is there to serve, the general population, have seen job stability and above inflation wage rises.

“When will the bubble burst?” headlines have been dragging on for a couple of years and yet so far there is little sign it actually will. GDP, DFI inflows and infrastructure investments are all projected to rise after a slow 2015, Brasil still holds one of the largest dollar reserves in the world, at present nearly US$400bn. But the slowdown does beg the question why, after 2010’s famous 7.5% GDP growth, has the country slowed so much. Firstly, the oft-quoted 7.5% was an anomaly created by a mixture of massive stimulus, post Great Recession, and also government spending to shore up the PT’s reelection after Lula’s second & final term. At the time the press slammed this figure for what it was, then later used it as a stick to beat the current government during the period of catch up that followed. The reality is that Brasil is a victim of its successes over the past 20 years, as investment in creaking infrastructure struggles to meet demand.

But outsiders struggle to understand that Brasil’s problems cannot be fixed at the flick of a switch and ignore the very low base the country started from, post-dictatorship. Part of Brasil’s problem is that it is not simply starting from nothing. Fixing an institutional failure is often more difficult than creating from scratch, and existing structures cannot simply be thrown out.

A good example of this is in education: Prior to 2002 Brasil invested very little on education or its population, which has improved vastly in terms of both expenditure and results, but they are both still too low. The fundamental problem is that the government cannot simply fire all of the poorly trained teachers, raze all the old schools and start afresh; pupils need to keep going to school. Keeping existing structures running while investing and improving is expensive and slow.

Political & Judicial reforms are indeed required, and a simplification of the tax code is already included in every major party manifesto. This will however, take more than a single term to achieve.

The Meddling State?

Another aspect of the the past four years that is reported without context is the root cause of perceived meddling in the economy by Rousseff and her economic team. Many new governments come into office with a big idea, and Rousseff’s was pushing down Brasil’s very high interest rates to stimulate investment as the government eased back on stimulus measures used during the 2008 Great Recession that had meant Brasil was one of the last major economies into recession and the first out.

After the hyper inflation of the early 1990s Brasil’s central bank maintained a very tight rein on potential inflation via high interest rates. But as inflation in the years following 2002 stayed at historic lows the thought in Brasilia was that dropping interest rates and allowing higher – although still historically low – inflation would stimulate private sector investment and add to productivity and infrastructure gains that are needed to further lower inflationary pressure, and therefore create a virtuous circle.

This was Rousseff’s “big idea” and from mid-2011, six months in office Brasil began the longest and deepest reduction is it’s SELIC rate in modern history, and this carried on until the first quarter of 2013, pushing rates from 12.5% to 7.5%.

This was a calculated risk, and one that many at the time supported as over due. After an initial trend towards the mid range of the Central Banks’ 2.5 – 6.5 target inflation started picking up pace, still historically low levels but, like Germany, Brasil’s policy markers are hyper sensitive to inflation, as are voters. It became clear very quickly that a combination of uncommon climatic factors pushing up food prices and increased demand across the service sector created by falling poverty and rising wages was creating an amber warning light in Brasilia.

Right here is the root of a number of policies that are described as “meddling” by Rousseff and her team. The usual editorial line could be summarised as “we always told you Rousseff was a Statist, here’s proof.” but the reality is far more nuanced. Firstly the two mayor actions that gave root to this mythology were pushing down Brasil’s electrical bills and obliging Petrobras, a private limited company which the Brazilian government owns a controlling stake, to sell imported refined petroleum at a loss. Why did Rousseff and her team do this? To offset the inflationary externalities caused by the previous policy of interest rate reductions.

External commentators on Brasil often set their view as a wish list rather than the reality of Brasil’s political and economic culture. Brasil is far more like France than the United States or United Kingdom and has always had a state with high involvement in Brasil’s market economy. The recent rise of Brasil’s stock market in line with declining polls for Rousseff is often given as proof that investors see Rousseff as a closet State Capitalist and that out of office market forces would return. Firstly they were never there, Brasil’s governments left, right and centre have all acted as corporatist administrations of various degrees. Secondly the BM&F Bovespa stock market in São Paulo operates with until recently Petrobras holding the highest weighting.

It is perfectly reasonable to believe that investors were wary of Rousseff’s policy of selling subsidised petroleum but there are also other factors at work. Petrobras’ pre-sal fields discovered in 2006 are now pumping half million barrels a day, record levels. The pumping levels are reportedly well above world averages and Petrobras’ projected extraction by 2020 (five years away) is 5 billion barrels a day. In context investors know that the currently subsidised petroleum selling is a short term measure to offset inflation in the wider economy, there has been a lot of noise that the policy would be lifted next year regardless of who is in the Alvorada Palace in Brasilia. So financial press speculation that a bull market in São Paulo is an indication of “investor dissatisfaction” with the current administration is wishful thinking. Yes, the Brazilian government does play a more strategic role in the economy than the Anglo-Saxon economies but Brasil would not be regarded as unique if comparing to Germany or France that, like Brasil, aspire to a Social Market system.

For all tomorrow’s parties

For those of us on solid ground in Brazil it does not feel like a crisis, nor even a slow motion car crash. Certainly the shine of the Lula years has come off, but no country can maintain it’s “feel good factor” indefinitely. All of the reputable short term projections for Brasil expect that the next 18 months of GDP expansion will remain low, into the mid and long term Brasil will rise back up to recommended levels of non-inflationary GDP growth of around 3.5% per year. Brasil weathered the Great Recession well, if we look back to 1998 we can see that not long ago a global event such as this would have sent Brasil into a tailspin of recession, inflation and IMF bailouts.

It is a testament to how far Brasil has come that today we talk about weak short term growth and refer to historically low inflation as “high”.

Brasil has a robust internal consumer market – currently under necessary protectionist policies, vast natural resources, one of the world’s most advanced and productive agronomical sectors, a quarter of the worlds fresh water and is a soon-to-be top 10 oil producer.

Brasil may not be achieving stability and success by following foreign editorial positions, but castigating a country for doing things on its own terms does no one a service, especially not readers that require news, not ideology to make decisions.